vermont sales tax exemptions

Avalara Tax Changes Midyear Update. This page describes the taxability of services in Vermont including janitorial services and transportation services.

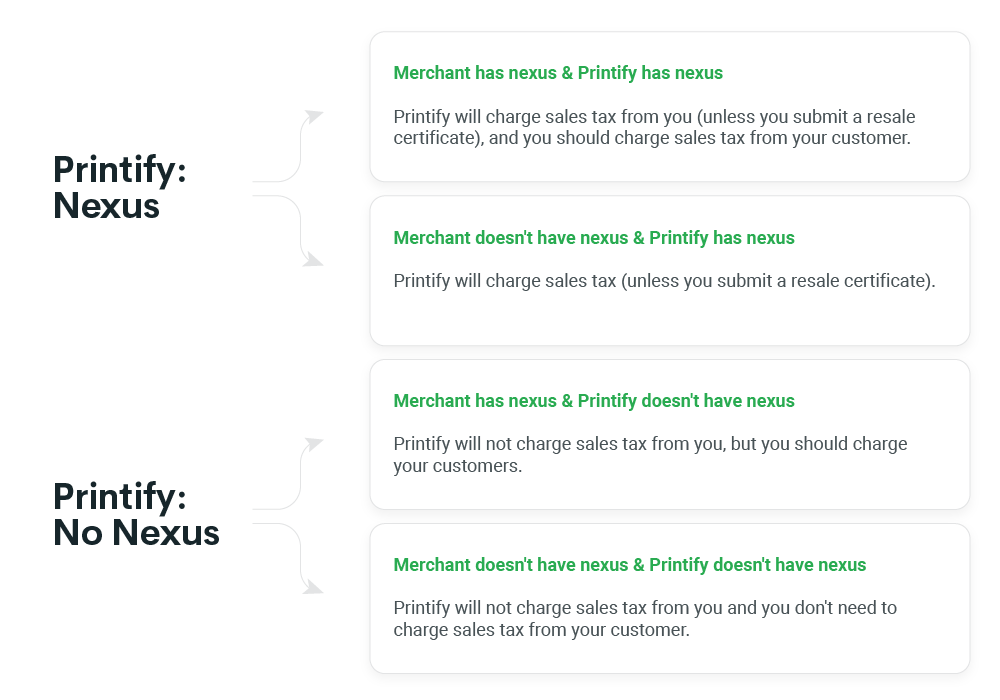

Understanding Sales Tax With Printify Printify

Vermont has a destination-based sales tax system so you have to pay.

. This page describes the taxability of. Here are the special category rates for Vermont. SALES AND USE TAX Subchapter 002.

Get the Avalara Tax Changes Midyear Update today. What is exempt from sales taxes in Vermont. Additionally wholesalers must pay a tax on spirits and fortified wines as follows.

Taxation and Finance Chapter 233. 974113 with the exception of soft drinks. Ad Fill out a simple online application now and receive yours in under 5 days.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Vermont CVR 10-060-023 Reg. Tax Bulletin 7-11.

Ad Fill out a simple online application now and receive yours in under 5 days. Is Vermont a high. Clothing EXEMPT Groceries EXEMPT Prepared Food 9 Prescription Drugs EXEMPT.

The Vermont Statutes Online Title 32. Examples include some agriculture supplies prescription drugs and medical supplies. Nexus and compliance laws industry news and more.

53 rows Division of Finance Administration Sales Use Tax Exemptions by State Present state sales tax exemption certificates to vendors hotels restaurants and other service providers in. Vermont Sales Tax Exemption Certificate information registration support. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Ad Keep up with changing tax laws. Sales tax exemption can only be. Ad Keep up with changing tax laws.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Nexus and compliance laws industry news and more. Vermonts sales tax rates for commonly exempted items are as follows.

We recommend businesses review the laws. Many states have special sales tax rates that apply to the purchase of certain types of goods or fully exempt them from the sales tax altogether. Some goods are exempt from sales tax under Vermont law.

A vehicle owned or leased by the. A partial exemption from the sales and use tax became available under section 63565 for the sale storage use or other consumption of farm equipment machinery and their. Beer over 6 percent alcohol by volume.

To learn more see a full list of taxable and tax-exempt items in. Form S-3 Form Wednesday March 16 2022 - 1200 Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit File S. Sales up to 500000.

Exemptions The following is a list of conditions that will allow you to register your vehicle exempt from payment of the Vermont Purchase and Use Tax. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Vermont sales tax you need the appropriate Vermont sales tax exemption certificate. Meals and Rooms Tax see p.

Restaurant meals may also have a special sales tax rate. Ad New State Sales Tax Registration. Where the manufacturing process begins and ends is described in Regulation 1974114 which is available on our website at wwwtaxvermontgov or can be obtained directly from the Vermont.

Grooming and Hygiene Products Taxable Medical Equipment Supplies Exempt Supplies Taxable Food Food Products and Beverages Exempt Food food products and beverages. 19242-3 Meals and Rooms Tax TB-13. Avalara Tax Changes Midyear Update.

This page describes the taxability of. There are additional levels of sales tax at local jurisdictions too. The state-wide sales tax in Vermont is 6.

Get the Avalara Tax Changes Midyear Update today. 9741 9741.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax Exemptions Finance And Treasury

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

States Without Sales Tax Article

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

Map State Sales Taxes And Clothing Exemptions Tax Foundation

States With Highest And Lowest Sales Tax Rates

Washington Sales Tax Small Business Guide Truic

Sales Tax Holidays Politically Expedient But Poor Tax Policy

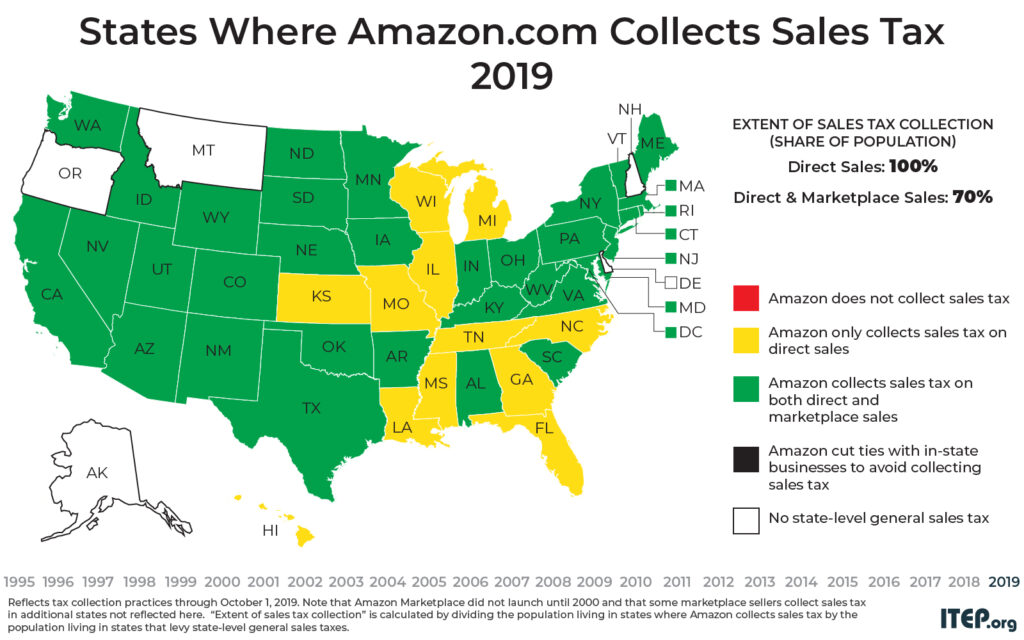

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

States Without Sales Tax Article

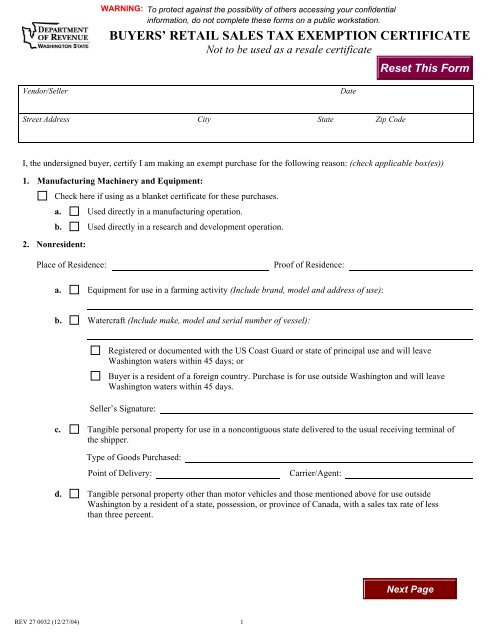

Buyers Retail Sales Tax Exemption Certificate

Sales Tax By State Is Saas Taxable Taxjar

State By State Guide To Taxes On Retirees Retirement Tax States

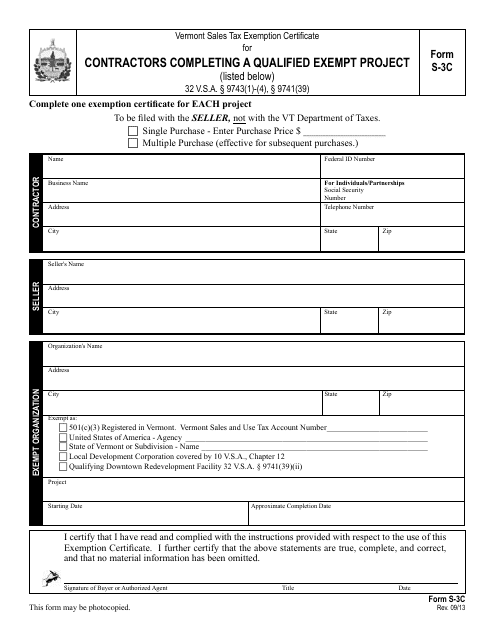

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller